Test & Tag Industry Snapshot 2026

What's changing across the test and tag industry right now - from compliance, training and equipment

The test and tag industry is usually fairly steady, but the last 12 months have brought real change.

Across Australia, we’re seeing compliance pressure increase, service models tighten, franchises grow, and expectations rise at the same time. These aren’t isolated changes. Together, they’re reshaping how test and tag businesses operate day to day.

This snapshot reflects what we’re seeing on the ground heading into 2026, based on training activity, service provider behaviour, franchise growth and equipment demand across Australia.

Franchises are absorbing sole traders – and reshaping the industry

One of the clearest trends we’re seeing is experienced sole traders moving into franchise and network models.

This isn’t about newcomers entering the industry, it’s operators who already know test and tag, and are choosing structure over independence.

From what we’re seeing, the reasons for switching are generally very practical:

- Better systems and support

- Less admin and fewer compliance headaches

- Stronger and more consistent lead flow

- A recognisable brand when bidding for larger work

This shift isn’t happening overnight, but it is steady. Franchise growth across Australia is forecast to continue at around 1–1.3% annually, and while that might sound modest, its impact on the test and tag space is noticeable.

Franchise-backed operators are lifting expectations around reporting, consistency and presentation. In parallel, more businesses are outsourcing their testing and tagging altogether, which tends to favour service providers who can demonstrate they have the systems, coverage and reliability at scale.

As a result, independent providers are increasingly competing directly with franchise-backed businesses on the same sites - often under tighter expectations than existed a few years ago.

Whether people like it or not, the industry is moving away from ad-hoc and informal approaches. Test and tag is becoming more structured, more professional, and more closely aligned with how other compliance services already operate.

For anyone looking to enter the industry, or reassess how they're operating, we've also outlined this in our guide on top 5 ways to start a test and tag business.

Compliance pressure is changing behaviours

There’s been a noticeable increase in safety blitzes and site audits over the past 12 months, and it’s doing more than just raising awareness - it’s actively changing how businesses behave.

We’ve touched on this repeatedly in our Test & Tag News updates, and it’s no surprise given what’s shifting from a WorkSafe point of view.

Earlier in 2025, SafeWork NSW started operating as an independent regulator, which has noticeably lifted scrutiny across both construction and broader commercial sites. This was something we flagged as a likely outcome at the time, and it’s clearly starting to play out on the ground.

Victoria has continued its strong enforcement approach through WorkSafe Victoria, particularly across construction, transport and manufacturing. South Australia has also placed increased focus on construction environments, especially around large-scale projects and key infrastructure corridors.

In Queensland, the scale of upcoming infrastructure projects, including Olympic-related builds - means heightened safety attention is not only expected, but unavoidable. With that level of activity comes predictable pressure around compliance, auditing and contractor accountability.

As a whole, the key shift we’re seeing isn’t “more rules” – it’s actually less avoidance.

What this looks like is

- Far fewer businesses skipping test and tag altogether

- More businesses bringing test back in-house

- Clearer responsibility and more formalisation around who does the testing

Beyond traditionally stricter industries like construction and mining, it’s been very encouraging to see an increased uptake across a variety of lower-risk industries, or areas where test and tag was sometimes delayed or deprioritised in the past.

Pricing for test and tag services is no longer the only deciding factor

Right now there's a distinctive split between:

- operators offering test and tag as a side service

- operators building it as a primary business

That split has always existed to some degree, but over the past couple of years the second group has been growing a lot faster - and it's changing expectations across the industry.

The clearest sign of this shift is pricing.

There’s now a widening gap between:

- operators charging extremely low prices

- service providers pricing properly for compliant, documented work

A few years ago, cheap pricing often won jobs - even when it undercut more established operators doing things properly. In many cases, good businesses were losing work simply because someone else came in dirt cheap.

What’s changed is how those low prices are being viewed.

Cheap pricing has long been associated with rushed testing, minimal documentation, or corners being cut. That doesn’t mean a low price automatically equals poor work, but today, it’s increasingly seen as a red flag rather than a bargain.

More established operators are moving in the opposite direction: taking on fewer jobs, tightening scope, improving documentation, and pricing in a way that reflects the responsibility and risk involved in compliant testing.

For businesses choosing a test and tag provider, this shift matters.

Price alone is no longer a reliable indicator of quality or compliance, certainly not compared to 10 years ago under earlier versions of the AS/NZS 3760 Standard. More clients are now asking how the work is done, not just how cheap it is.

Equipment choice is becoming a bigger decision

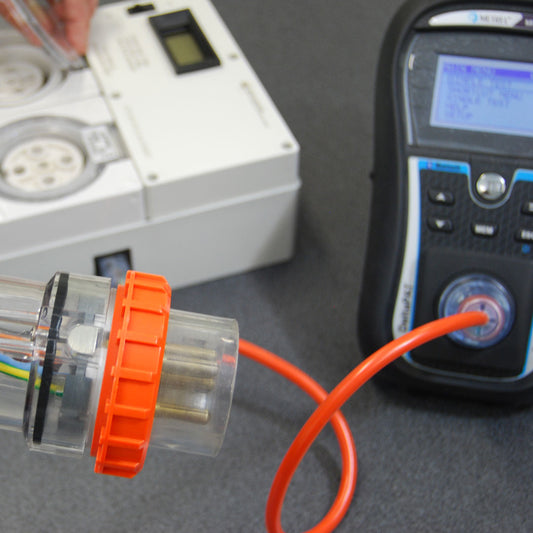

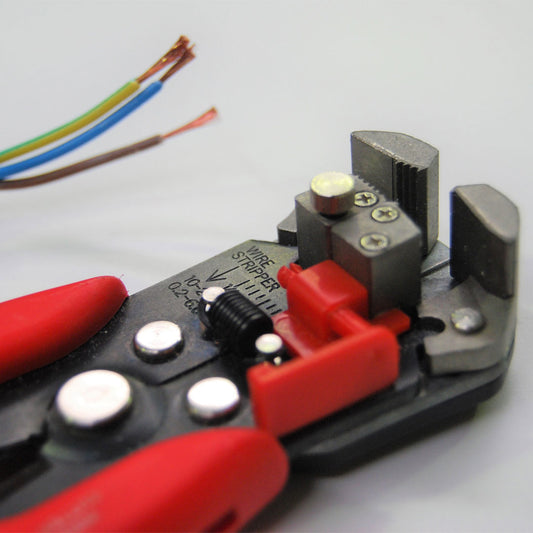

One of the clearest signals we’re seeing is how people think about PAT testers and test and tag equipment.

A few years ago, the starting point was often price - what's the cheapest appliance tester that will do the job. For many test and taggers, equipment was seen as a one-off purchase rather than something that shaped how they worked day to day.

We're now seeing the conversation shift towards:

"What will save me time on site?”

"What works best for proper reporting?”

“What can be upgraded as my work grows?”

Entry-level appliance testers still have a place, but there’s clear growth in demand and uptake of printer-compatible testers, equipment designed for repeat testing at scale, and testers with proper data logging capability.

Changes to the Australian Standard AS/NZS 3760 in 2022 - particularly the way data logging is referenced - have only accelerated this shift. More operators are actively looking for test and tag machines that support accurate record keeping and defensible reporting, rather than simply meeting the bare minimum. Not every unit does this well, and that’s becoming more widely understood.

For businesses weighing these decisions, we’ve covered this in more detail in our portable appliance tester buying guide, which breaks down what actually matters in real-world use.

For many businesses, equipment is no longer just a purchase decision. It’s part of how they operate, how efficiently they work, and how confidently they can stand behind their compliance.

A shift in why people attend test and tag courses

Training numbers have remained fairly steady, but expectations around what training should provide have changed.

We’re increasingly speaking to people who are working in environments where test and tag is required and are realising that short, fast courses don’t give them the understanding or confidence they expected. Not because they’ve failed an audit, but because expectations around responsibility and accountability are clearer than they used to be.

In some industries and on certain sites, nationally recognised training has always been required. What’s changed is that the same level of expectation is now appearing in places where short courses were once considered acceptable.

It’s no longer good enough to finish a course quickly. People want to understand their responsibilities and how test and tag actually fits into compliance.

As a result, the gap between short courses and nationally recognised training has become far more obvious. Short courses may to some on price or speed, but more people are recognising their limitations when it comes to responsibility, documentation and credibility.

We recognised this shift last year and removed our short course option entirely, choosing to focus only on nationally recognised training that reflects how test and tag is being viewed and assessed in the real world.

People aren’t choosing test and tag training just to get a certificate anymore. They’re choosing training that carries weight and matches the expectations they’re now operating under.

AI early adoption is still waiting

AI isn’t reshaping test and tag overnight but it’s starting to influence how larger and more organised operators think about their workflows.

Some of the areas that are inevitably being discussed are

- smarter reporting and record management

- scheduling tools that reduce missed testing intervals

- better visibility across jobs, technicians and sites

There’s also growing curiosity around whether AI could eventually be embedded into PAT testers themselves, particularly around reporting accuracy, diagnostics and long-term equipment performance. That’s still early days, but it’s clearly on the radar.

For franchise networks and higher-volume operators especially, the shift toward systems and data-driven decision-making feels inevitable. As operations scale, manual processes start to break, and technology becomes less of a “nice to have” and more of a requirement.

This is one area we’ll be watching closely over the next 12 months.

The bigger picture

Across the board, expectations around test and tag are lifting - and that's a positive shift for the industry.

Compliance is being checked more often, clients are asking better questions, and service providers are being compared on more than just price. The operators who invest in proper training, fit-for-purpose equipment and solid systems are pulling ahead. The rest are finding it harder to keep up.

These observations are drawn from ongoing training delivery, extensive survey's, support conversations, and real-world engagement with service providers and franchise networks across Australia. Together, they point to an industry that’s becoming more professional, more accountable, and harder to shortcut.

Featured Courses

-

Face to Face Test & Tag Course

Regular price $499.00Regular priceUnit price / per -

Online Test & Tag Course

Regular price $469.00Regular priceUnit price / per$499.00Sale price $469.00Sale -

3 Phase Test & Tag Course

Regular price $249.00Regular priceUnit price / per -

Plug Top Replacement Course

Regular price $249.00Regular priceUnit price / per